Best Finance AI Chatbots in 2025: Benefits, Use Cases, & Top Solutions

In today’s fast-paced digital world, financial institutions are under growing pressure to deliver faster, smarter, and more personalized customer experiences. Enter finance AI chatbots — intelligent virtual assistants that are reshaping how banks, fintech companies, and insurance providers interact with their clients.

In this blog, we explore the best AI tools for finance in 2025, highlight their benefits and use cases, and help you choose the right solution for your organization. Whether you’re a startup or an enterprise, the future of finance is conversational — and it’s powered by AI.

Table of Contents

- What is a Financial AI Chatbot?

- Why Use an AI Chatbot in Finance?

- Key Use Cases of AI Chatbots in the Finance Sector

- Top 10 AI Chatbots for Finance

- Future Trends in Financial AI Chatbots

- How to Choose the Right AI Chatbot for Finance?

- Build Custom Finance AI Chatbots with Kaopiz

- Conclusion

- FAQs

What is a Financial AI Chatbot?

A financial AI chatbot is an artificial intelligence-powered virtual assistant designed specifically for the finance industry. It leverages technologies like natural language processing (NLP), machine learning, and predictive analytics to understand user queries, provide real-time responses, and automate financial services.

Unlike traditional chatbots with rigid scripts, AI chatbots for finance can interpret complex financial language, deliver personalized experiences, and continuously improve through interaction. These chatbots are used by banks, fintech companies, insurance providers, and investment firms to serve both customers and internal teams.

Why Use an AI Chatbot in Finance?

As digital transformation accelerates across the financial sector, more institutions are adopting chatbots to meet rising customer expectations, reduce costs, and improve operational agility. Here are the key benefits of AI chatbot for finance:

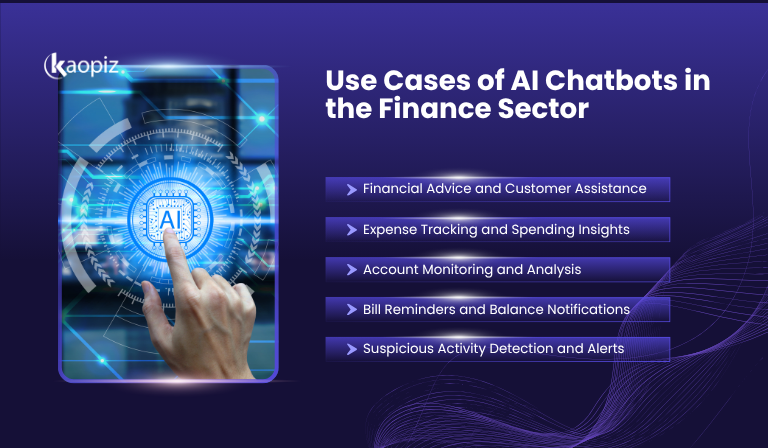

Key Use Cases of AI Chatbots in the Finance Sector

AI chatbots are transforming how financial institutions engage with customers, manage risk, and streamline internal processes. From customer service to fraud detection, the versatility of finance AI chatbots makes them indispensable for modern banking and fintech operations.

Here are five of the most common and impactful use cases for AI chatbots in the finance industry:

Financial Advice and Customer Assistance

AI chatbots can be configured to provide basic financial advice and answer frequently asked questions. While they don’t replace human financial advisors, they efficiently handle:

When a customer’s query goes beyond the chatbot’s scope (e.g., investment advice), it can seamlessly escalate the conversation to a human advisor.

Example: Talkbank’s chatbot “Buffet” (named after Warren Buffett) helps users with everyday financial questions before routing complex cases to human agents.

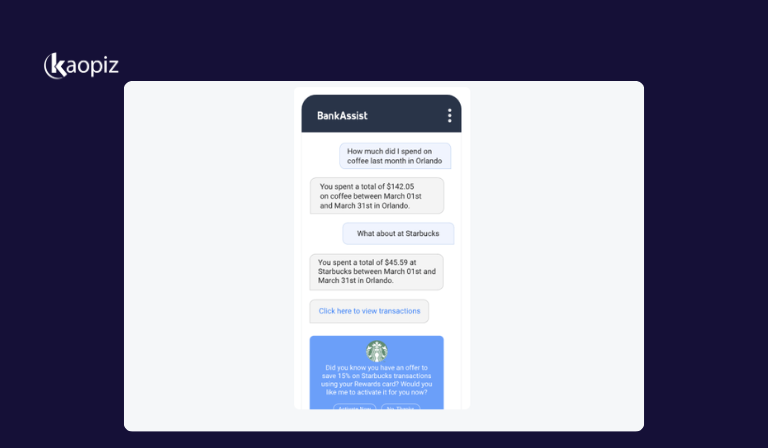

Expense Tracking and Spending Insights

Personal finance chatbots help users manage their budgets and keep spending in check by:

This empowers users to take control of their finances, without having to contact a bank or financial advisor every time. Chatbots reduce agent workloads and enable users to view expense summaries instantly within the chat interface.

Account Monitoring and Analysis

Finance chatbots can enhance transparency by giving customers instant access to account information:

With 61% of banking consumers interacting with their bank via digital channels weekly, this capability allows institutions to meet customers where they are — with fast, conversational service.

Imagine a customer simply typing “How much did I spend on groceries this month?” and receiving an instant, accurate breakdown from the chatbot.

Bill Reminders and Balance Notifications

One of the most appreciated features of AI chatbots for finance is proactive notification:

This helps users avoid late fees, stay within budget, and maintain good credit, while reducing awkward collections calls for staff. Bots can also let users set custom reminders based on due dates or spending limits.

Suspicious Activity Detection and Alerts

Security is critical in finance, and AI chatbots play a key role in fraud prevention. Chatbots can:

Example: A chatbot can immediately flag a transaction made from an unfamiliar location and ask the user, “Did you authorize this?” — helping prevent fraud before damage occurs.

Top 10 AI Chatbots for Finance

Let’s be honest — while there are plenty of chatbot platforms on the market, very few are purpose-built for the finance industry. The needs of financial institutions are unique, requiring high levels of security, compliance, and domain-specific functionality. So, which platforms truly stand out?

We’ve rounded up 10 of the best AI chatbots for business — from general-purpose models with strong financial use cases to specialized solutions tailored specifically for banking, fintech, and insurance.

ChatGPT by OpenAI

ChatGPT is a powerful conversational AI developed by OpenAI, known for its advanced language understanding and flexibility. While it’s not built specifically for finance, it can be customized to handle a wide range of financial use cases through API or ChatGPT Enterprise.

Features:

Pros and cons:

| Pros | Cons |

|---|---|

| Highly customizable | Not finance-specific by default |

| Scalable for internal and customer use | Requires setup and fine-tuning |

| Secure and enterprise-ready | Higher cost at scale |

| Fast integration across platforms |

Verdict:

A top choice for companies seeking a flexible, secure, and intelligent AI chatbot foundation for finance applications.

Bing AI by Microsoft

Bing AI is Microsoft’s conversational AI built on OpenAI’s GPT-4, integrated with the Bing search engine and Microsoft Edge. While not designed exclusively for finance, it offers strong capabilities for customer engagement, document summarization, and internal automation — especially for organizations already using Microsoft’s ecosystem (like Azure or Microsoft 365).

Features:

Pros and cons:

| Pros | Cons |

|---|---|

| Seamless integration with Microsoft 365 | Limited customization for finance-specific tasks |

| Real-time data from web search | Less control over chatbot behavior |

| Strong security via Azure | Not suited for complex financial workflows |

| Easy to deploy in Microsoft environments | Requires Microsoft ecosystem alignment |

Verdict:

Ideal for financial institutions already using Microsoft products that want a fast, secure, and intelligent chatbot with access to real-time information.

Gemini by Google

Gemini is Google’s conversational AI powered, formerly Bard. Known for its ability to pull real-time data from the web, Gemini can be a valuable tool for financial professionals looking for quick insights, stock updates, or help with economic terminology.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Real-time financial and economic data | Not tailored for deep finance workflows |

| Google Workspace integration | Limited API support for full customization |

| Strong for quick research and summaries | Less enterprise-grade control and governance |

| Easy to use for financial professionals | Requires manual fine-tuning for secure use |

Verdict:

Best suited for finance teams or analysts needing real-time insights, quick definitions, and market updates — especially within a Google-centric workflow.

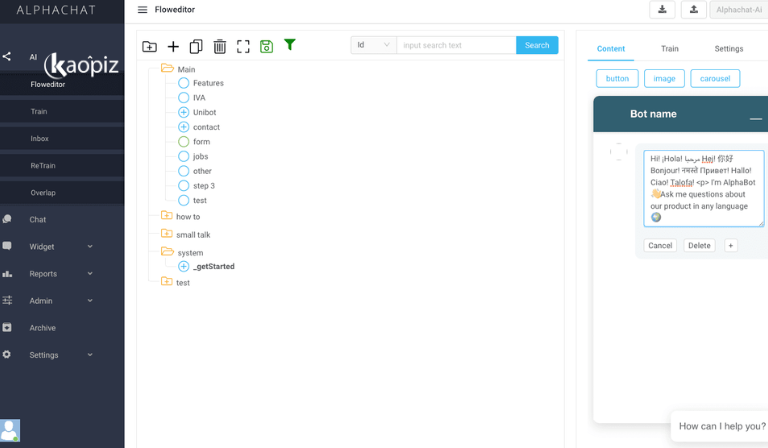

AlphaChat

AlphaChat is an AI-driven chatbot platform built to enhance customer support in the finance industry. It helps users manage accounts, process payments, and get real-time answers to common financial queries.

It also includes analytics and intent detection, allowing financial institutions to identify common pain points and optimize service delivery. Deployment is flexible across multiple channels like WhatsApp, Messenger, and Apple Business Chat.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Thousands of pre-built conversation topics | Limited intent functions (e.g., scheduling not supported) |

| Easy-to-use visual editor for chatbot content | No visual flow of the customer’s chat journey |

| Strong analytics and reporting capabilities |

Verdict:

A great choice for finance companies needing a user-friendly, multilingual chatbot with cross-platform capabilities and powerful customer support automation.

Kasisto (KAI)

Kasisto (KAI) is a leading AI chatbot platform built specifically for the finance sector, trusted by banks and fintech companies worldwide. Known for its NLP and financial expertise, Kasisto delivers personalized financial advice, helps users manage their accounts, and responds to common banking inquiries — all while improving digital engagement.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Built specifically for finance institutions | Occasional bugs reported by users |

| Strong intent builder and customization options | Limited reporting and analytics tools |

| Supports multiple interaction modes (text, voice, touch) | Primarily focused on customer service |

| Provides actionable, personalized financial insights |

Verdict:

Kasisto is one of the best finance-specific AI chatbots, ideal for banks and fintechs seeking personalized, real-time customer service and engagement rooted in financial expertise.

Cleo

Cleo is a personal finance AI chatbot designed to help users manage their money in a fun, conversational, and engaging way. It offers budgeting tools, spending analysis, and financial tips — all delivered with a touch of humor and personality. Cleo is especially popular among younger users who prefer a casual, mobile-first approach to managing their finances.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Engaging and humorous user experience | Not suitable for complex financial tasks |

| Great for budgeting and spending awareness | Limited features for enterprise or B2B use |

| Popular among Gen Z and millennials | No deep investment or credit analysis |

| Easy to use and quick to set up |

Verdict:

Cleo is ideal for individuals, especially younger users, who want a light, engaging way to stay on top of their finances. It’s not a tool for enterprises, but it excels at promoting financial literacy and budgeting discipline in a user-friendly format.

Tidio

Tidio is an all-in-one customer service and chatbot platform that helps financial institutions improve client support, capture leads, and increase engagement. Its AI-powered chatbots can be customized for finance-specific use cases, such as booking consultations, handling FAQs, or collecting client data — all in real time.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Easy to set up with visual chatbot builder | More focused on sales and support, not deep finance workflows |

| Finance-ready templates (e.g., meeting scheduling) | Limited financial analytics and advisory features |

| Multichannel support across web and social media | May require third-party tools for advanced CRM needs |

| Free plan available to test features |

Verdict:

Tidio is a great choice for financial businesses looking to improve customer engagement and lead generation through customizable, real-time chatbots, without heavy technical effort.

Kore.ai

Kore.ai is a leading enterprise conversational AI platform, named a Leader in the 2023 Gartner Magic Quadrant. It empowers financial institutions to automate accounting, procurement, and customer support tasks using intelligent finance bots.

Designed for both back-office efficiency and customer-facing service, Kore.ai supports automated invoice processing, expense tracking, and balance notifications. It also functions as a conversational banking assistant, helping clients manage payments and stay updated on their financial status.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Intuitive visual builder for easy chatbot creation | Reporting and analytics features are limited |

| Powerful NLP capabilities across three engines | Chat/session management can be improved |

| Broad integration options with messaging platforms |

Verdict:

Kore.ai is a strong choice for banks and finance teams looking to automate workflows, improve customer service, and enhance financial operations through advanced conversational AI.

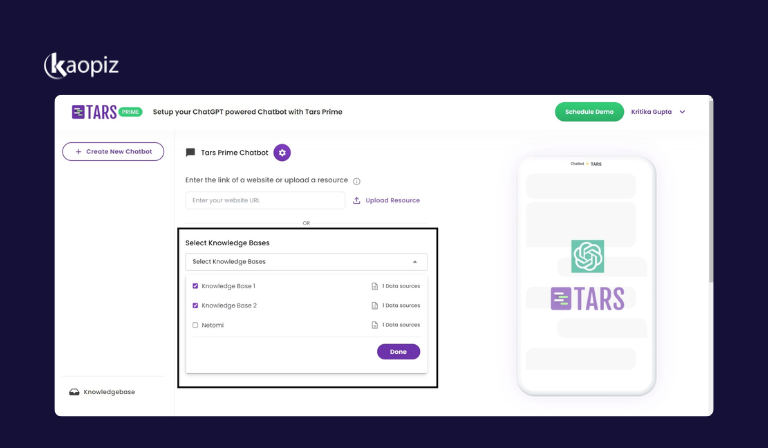

TARS

TARS is a chatbot platform designed to optimize conversion funnels, improve customer experience, and automate customer service interactions for online businesses — including financial institutions. When a visitor lands on your banking site, TARS greets them with a conversational prompt, creating a more personal and human-like interaction.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Extensive finance/banking chatbot templates | Limited customization options for advanced use |

| Simple and fast configuration | Some users report integration issues with analytics |

| Supports personalized experiences with geolocation features |

Verdict:

TARS is a great option for financial institutions looking to deploy quick, low-code chatbots that engage users, guide them through services, and boost conversion — all without overwhelming the end-user.

Haptik

Haptik is a conversational AI platform that helps businesses manage the entire customer journey — from discovery and purchase to post-sale support. Tailored for industries like finance and insurance, Haptik’s virtual assistants are built to boost operational efficiency, increase revenue, and deliver personalized customer experiences.

Features:

Pros & Cons:

| Pros | Cons |

|---|---|

| Robust analytics platform for performance tracking | Limited onboarding guidance for Smart Agent Chat |

| Fast and responsive customer support | No real-time issue reporting |

| Pre-built flows for common financial use cases |

Verdict:

Haptik is a strong choice for financial institutions that want to deliver a personalized, sales-driven chatbot experience while supporting customers across the entire service lifecycle.

Future Trends in Financial AI Chatbots

As AI continues to evolve, financial AI chatbots are becoming more intelligent, human-like, and integral to digital finance strategies. Here are key trends shaping the future of chatbots in the financial sector:

How to Choose the Right AI Chatbot for Finance?

Choosing the right AI chatbot for finance starts with understanding your goals. Whether it’s answering customer queries, tracking expenses, or offering financial advice, the right tool should align with your specific use cases.

Key Considerations:

Build Custom Finance AI Chatbots with Kaopiz

At Kaopiz, we help financial institutions and fintech companies build tailor-made AI chatbots that go beyond basic automation. Whether you’re a bank, insurance provider, or personal finance app, our team works closely with you to develop secure, scalable, and intelligent chat solutions that meet your specific needs.

Why Choose Kaopiz for Finance Chatbot Development?

Whether you need a chatbot to improve customer service, reduce operational costs, or drive more conversions, Kaopiz is your trusted partner for custom finance AI chatbot development.

Conclusion

AI chatbots are transforming the financial industry by automating routine tasks, improving customer engagement, and delivering personalized financial support — all while ensuring efficiency and compliance.

As you explore chatbot solutions, focus on platforms that align with your goals, integrate with your systems, and prioritize security. Whether you’re a bank, fintech startup, or insurance provider, investing in the right AI chatbot can enhance your service delivery and give your business a competitive edge.

At Kaopiz, we specialize in building custom financial AI chatbots tailored to your needs — secure, scalable, and smart. If you’re ready to elevate your digital customer experience, our team is here to help.

FAQs

How Secure are AI Chatbots for Banking?

AI chatbots used in banking are built with enterprise-grade security, including data encryption, access control, and secure APIs. Many platforms also comply with industry standards like GDPR, SOC 2, and PCI-DSS to ensure data protection. However, security also depends on proper implementation, regular monitoring, and integration with your existing IT infrastructure.

Can AI Chatbots Provide Financial Advice?

Yes — but with limitations. AI chatbots can provide general financial guidance, budgeting tips, and product recommendations based on user data. However, they cannot replace licensed financial advisors for personalized investment or legal advice. Most financial chatbots are programmed to escalate complex queries to human experts when necessary.

How Much Does It Cost to Implement an AI Chatbot in Finance?

Costs vary depending on the platform, features, customization, and integration required.

Ongoing costs may include maintenance, updates, API usage, and analytics support.

3 Replies to “Best Finance AI Chatbots in 2025: Benefits, Use Cases, & Top Solutions”

Leave a Comment

Trending Post

Pingback:From SERP to LLM: Mapping the New Customer Journey in a GEO World - Kingy AI

Pingback:How to Create Your Own AI Bot: Full Guide with Current Trends, Tools, and Expert Advice

Pingback:What Is a Chatbot? Benefits of Chatbots for Websites. – Natraj IT Solutions Blog